1.

Q:

When did the collection of the Hotel Accommodation Tax ("HAT") resume?

A:

The collection of HAT resumed on 1 January 2025, with a tax rate of 3% on accommodation charge.

A:

According to the Hotel Accommodation Tax Ordinance (Cap. 348), HAT is levied on all accommodation charges made by a hotel or a guesthouse.

"Accommodation charge" means "the sum payable by or on behalf of guests for accommodation received"; "Accommodation" means "any furnished room or suite of rooms hired by the proprietor of the hotel to guests, or for the use of guests, for lodging and includes such furnishings, appliances and fittings as are normally provided therein". Hence, accommodation charge includes all charges generally payable for providing hotel accommodation such as extra beds, cribs, holiday / themed decorations and late check-out.

Service charge (normally at 10% of accommodation charge), in-house dining expenses, charges for hotel facilities (such as spa massage, chauffeur-drive and beauty treatment), services of the business centre (such as printing, fax, photocopying and rental of conference rooms) and concierge services (such as tickets booking, restaurant reservation and car rental services), and additional charge for consumable items (such as extra toiletries and personal hygiene items) are not required to be included in the calculation of HAT.

A hotel is only required to pay to the Inland Revenue Department (“IRD”) the amount of HAT payable. All other payments collected from guests should be handled by the hotel itself.

3.

Q:

What are the meanings of “hotel” and “accommodation”?

A:

According to the Hotel Accommodation Tax Ordinance, “hotel” means “any establishment, the proprietor of which holds out to the extent of his accommodation that he will provide accommodation to any person presenting himself who is able and willing to pay a reasonable sum for the services and facilities provided and is in a fit state to be received”.

“Accommodation” means “any furnished room or suite of rooms hired by the proprietor of the hotel to guests, or for the use of guests, for lodging and includes such furnishings, appliances and fittings as are normally provided therein”. Therefore, the charges for furnishings, appliances and fittings provided in a hotel room will be included in the calculation of HAT.

4.

Q:

Will certain hotels be exempted? Will a hotel operated by a non-profit making organisation be eligible for the exemption?

A:

According to the Hotel Accommodation Tax Ordinance, accommodation that is exempted from HAT includes that provided by: (i) a hotel containing less than 10 rooms normally available for lodging guests; and (ii) a society not established or conducted for profit.

The Hotel Accommodation Tax Ordinance has not defined “a society not established or conducted for profit” (“non-profit-making society”). Generally speaking, all charitable bodies that have been granted tax-exempt status under section 88 of the Inland Revenue Ordinance (“IRO”) will be accepted by the Inland Revenue Department (“IRD”) as non-profit-making societies. In other words, if a hotel or guesthouse is operated by these charitable bodies, it will be exempted from payment of HAT.

For a hotel or guesthouse which is operated by a non-profit-making society other than the above-mentioned charitable bodies, IRD will consider it on a case-by-case basis having regard to the society’s own circumstances. IRD will examine the governing instrument for the establishment of the society to ascertain whether it meets the conditions of a non-profit-making society. In general, a non-profit-making society should have the following features: the objects and operation of the organisation are not to make profit; its funds will only be used to achieve its objects; and its income, profits, surplus and property (whether or not generated from operating hotels or guesthouses) will not be distributed among its members, organisation owners, shareholders, etc. Non-profit-making societies should also keep sufficient records of income and expenditure (including donation receipts), proper accounting books and compilation of annual financial statements for review by the IRD when necessary. It is worth noting that non-profit-making societies are not necessarily charitable bodies. Unless exempted under section 88 of the IRO, such societies do not have tax-exempt status under the IRO.

5.

Q:

For a person who holds a number of guesthouse licenses with the same business name and the premises used as guesthouse are located in the same building/complex, if the number of rooms available for lodging guests in each license is less than 10 when counted individually but will be 10 or more than 10 when counted together, is the accommodation charge received by the person exempt from HAT?

A:

Apart from the number of guesthouse licences, the IRD will also take into consideration the actual operation of the guesthouse and whether it operates one or more businesses.

In simple terms, all guesthouse licensed premises under the same business registration will be regarded as the place of business of the same business. If the licensee applies for business registration separately for different licensed premises, the business at each premises will be regarded as a separate business. If there is less than 10 rooms for lodging guests at each premises, the related accommodation charge is exempted from HAT.

On the contrary, if the licensee applies for only one business registration for all premises, then the business operated at all premises will be regarded as the same business. Therefore, the business so operated has 10 or more rooms available for lodging guests. All related accommodation charges will not be exempted from HAT.

6.

Q:

How is HAT calculated?

A:

HAT is levied at the rate of 3% on accommodation charges, which are the sum payable by or on behalf of a guest for the accommodation received (irrespective of whether the charges are calculated on a daily or hourly basis). Service charges are exempted from HAT. Please refer to Q2 for more details.

Example: If the room rate and service charge are $1,000 and $100 respectively, HAT is $30.00 (i.e. $1,000 × 3% = $30.00)

7.

Q:

The effective date of resumption of HAT collection is 1 January 2025. If a hotel room is booked for the period from 31 December 2024 to 3 January 2025, how is HAT calculated?

A:

Out of the three hotel room nights, only the accommodation charge for the two nights on 1 and 2 January 2025 is chargeable to HAT. Taking the accommodation charge of a room is $1,000 per night as an example, HAT is $60.00 (i.e. $1,000 × 2 × 3%).

8.

Q:

Are service apartments subject to HAT?

A:

In general, unless specifically exempted, HAT is charged on all hotels, guesthouses or service apartments falling within the meaning of “hotel” under the Hotel Accommodation Tax Ordinance when rooms are provided to guests. For a service apartment which is clearly not accommodation provided to a “guest” (e.g. a service apartment that is not provided as a sleeping accommodation, which is excluded from the application of the Hotel and Guesthouse Accommodation Ordinance (Cap. 349)), the IRD generally accepts that it is excluded from the charge of HAT. However, the service apartment, guesthouse or hotel is required to keep sufficient records to reflect its mode of operation or the accommodation details of the guests.

9.

Q:

If a hotel provides both short-term and long-term accommodation, does the hotel need to pay HAT in respect of the rooms used for long-term accommodation?

A:

For an occupant staying in the same hotel for not less than 28 consecutive nights (even if there is a room change), the case will be regarded as long-term accommodation. If the hotel provides both short-term and long-term accommodation, the accommodation charges for long-term accommodation are not subject to HAT. Hotels must keep the accommodation information and records of the occupants for at least 6 years for future inspection by the IRD.

10.

Q:

Does a hotel need to designate individual floors or rooms for long-term accommodation? Is the accommodation information relating to long-term accommodation required to be reported?

A:

The hotel is not required to designate individual floors or rooms for long-term accommodation or notify the IRD of the long-term accommodation arrangements in advance. However, the hotel must keep the long-term accommodation occupancy information and relevant supporting documents, including but not limited to the signed tenancy agreements (if any), rental receipts, proof of stay etc., for at least 6 years for future inspection by the IRD.

11.

Q:

Is there any requirement that the same guest must stay in the same hotel room for not less than 28 consecutive nights so that the room charges will not be chargeable to HAT?

A:

HAT is not chargeable so long as the occupant stays in the same hotel for not less than 28 consecutive nights and the stay is regarded as long-term accommodation. The occupant can change room during the period of stay.

12.

Q:

If a guest originally plans to stay for 10 nights, but subsequently extends the stay several times to more than 28 nights, is the guest’s accommodation subject to HAT?

A:

So long as the occupant stays in the same hotel for not less than 28 consecutive nights, the stay will be regarded as long-term accommodation, and the relevant accommodation charge will not be subject to HAT. The HAT paid by the occupant during the initial stay can be handled by the hotel itself.

13.

Q:

When a guest changes the period of stay from a long-term stay (i.e. not less than 28 consecutive nights) to a short-term stay or vice versa, how should this change be reported in the HAT return? (NEW)

A:

The hotel can make adjustments in the month of change. If the change is across quarters, the hotel needs to make the adjustments in the return for the next quarter and to pay the relevant amount of HAT which should be payable for the last quarter or deduct the relevant amount of HAT already paid for the last quarter, as the case may be.

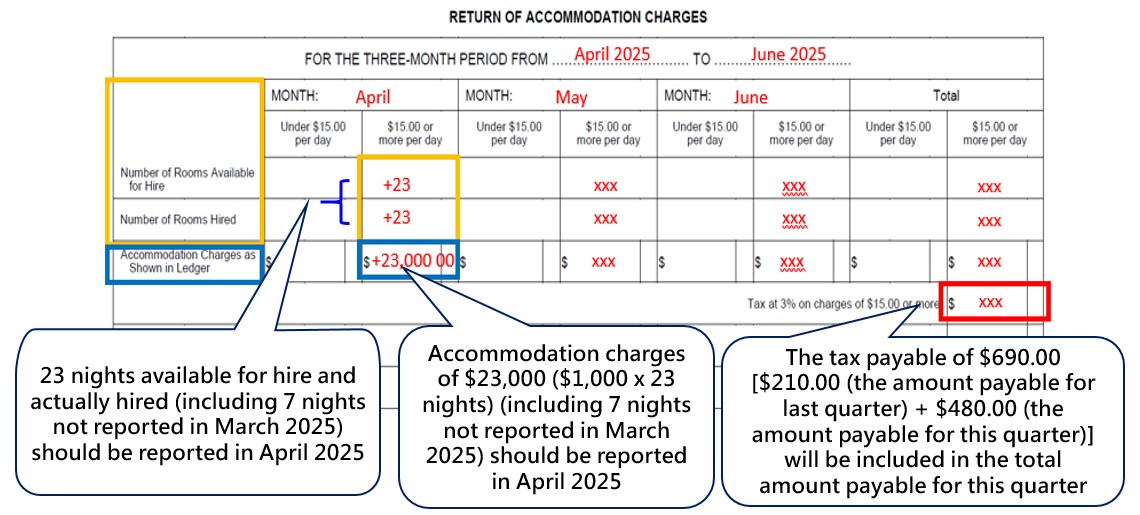

Example 1:

A room is booked for 30 consecutive nights from 25 March to 24 April 2025 at a daily rate of $1,000. The accommodation charges for the booking of not less than 28 consecutive nights are not subject to HAT. Subsequently, the guest shortens the period of stay and checks out on 17 April 2025. He stays for 23 nights and pays accommodation charges of $23,000.

HAT of $690.00 is required to be paid, which is calculated as follows:

25 March to 1 April 2025 (1st quarter, 2025):$1,000 x 7 nights x 3% = $210.00

1 April to 17 April 2025 (2nd quarter, 2025):$1,000 x 16 nights x 3% = $480.00

The hotel should make the following adjustments in April 2025 (i.e. the month of change):

Note: If, according to the contract, the guest checks out early, he will still be charged for the unused nights. No HAT will be payable, if accommodation charges for not less than 28 consecutive nights are paid.

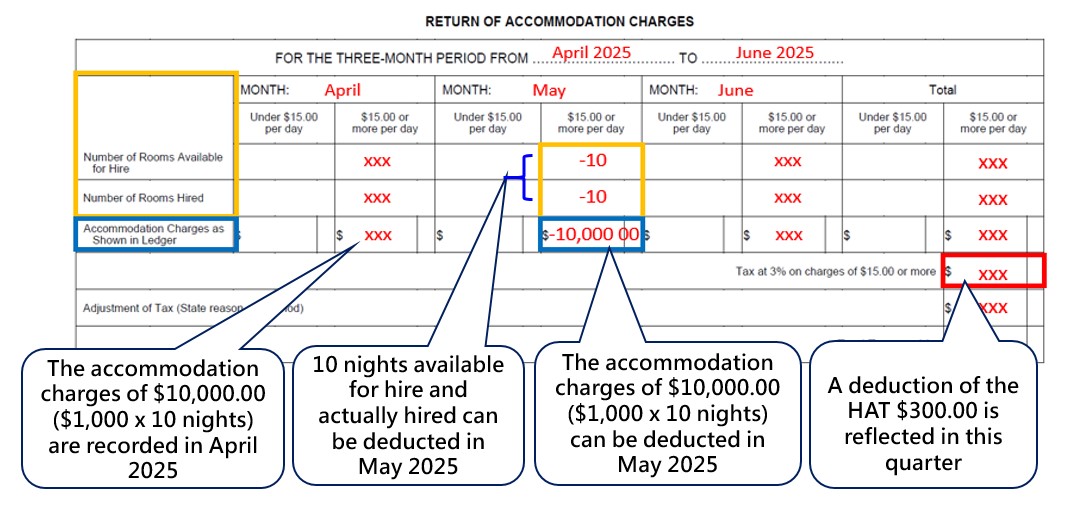

Example 2:

A guest initially books a room for 10 nights from 20 April 2025 at a daily rate of $1,000, and pays accommodation charges of $10,000 and HAT of $300.00 ($1,000 x 10 nights x 3%). The hotel records the relevant HAT details in April 2025. Later, the guest extends his stay to 30 May 2025 and stays for a total of 40 nights (i.e. not less than 28 consecutive nights).

The accommodation charges of $10,000 and HAT of $300.00 recorded in April 2025 can be deducted in May 2025 (i.e. the month of change) and reported as follows:

14.

Q:

If a guest checked in a hotel in mid-December 2024 and checked out in mid-January 2025, the stay of 28 consecutive nights covers a period before the commencement of HAT collection. In this circumstance, will the guest's accommodation be subject to HAT?

A:

Regardless of when an occupant checks in the hotel, so long as the occupant stays in the same hotel for not less than 28 consecutive nights, the stay will be regarded as long-term accommodation, and the relevant accommodation charge will not be subject to HAT.

15.

Q:

If a guest with long-term accommodation needs to change to another hotel for continuous stay due to force majeure (for example, the room needs repairs but the hotel has no spare room), does the guest's continuous accommodation need to be recounted?

A:

If an occupant and a hotel make an agreement that the occupant will stay in the hotel for not less than 28 consecutive nights, but due to force majeure, the hotel has to arrange the occupant to change to another hotel to continue the accommodation, the occupant will be regarded as if he/she had never changed hotel and the related accommodation charges will not be subject to HAT.

16.

Q:

When a hotel room is hired out through a travel agent (including an online travel agent (“OTA”)), the room rate displayed by the travel agent may be different from the actual amount received by the hotel (after deduction of other charges such as commission by the travel agent). Which amount should be charged to HAT? How should the details be reported in the Return of Accommodation Charges? (NEW)

A:

If a guest books a hotel room through a travel agent (including an OTA), HAT shall be calculated solely based on the room rate provided by the hotel to the travel agent.

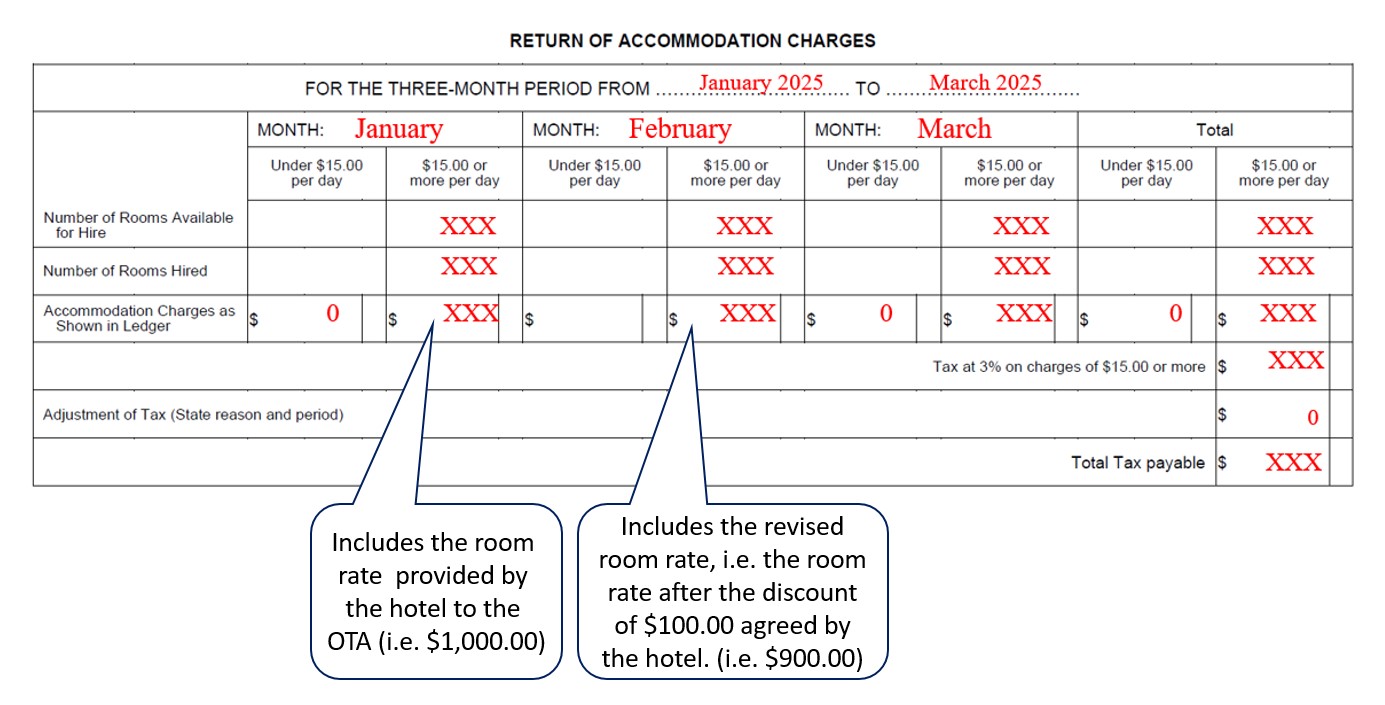

Example 1:

In January 2025, the room rate provided by the hotel to an OTA was $1,000. The hotel actually received a sum of $1,100 from the OTA inclusive of service charge but before deduction of OTA’s commission).

HAT shall be calculated based on the room rate provided by the hotel to the OTA. HAT is calculated as follows:

$1,000 x 1 night x 3% = $30.00

The actual amount received by the hotel from the OTA, and the commission paid to OTA will not affect the calculation of HAT.

Example 2:

In February 2025, the room rate provided by the hotel to an OTA was $1,000. A discount of $100 was then agreed by the hotel. The OTA finally offered a total discount of $150 (including a discount of $50 provided by the OTA for its own business purpose) to the guest. The room rate after the total discount was $850.

HAT shall be calculated based on the revised room rate (i.e. the room rate after the discount agreed by the hotel). HAT is calculated as follows:

($1,000 - $100) x 1 night x 3% = $27.00

The discount offered by the OTA for its own business purposes is a non-deductible item.

The Return of Accommodation Charges should be completed as follows: -

17.

Q:

If an OTA uses the selling price of the room instead of the room rate provided by a hotel for the purposes of accounting, does the hotel need to account for the transactions by itself for the purpose of computing HAT?

A:

HAT shall be calculated based on the room rate provided by the hotel to the OTA. The hotel should make adjustments accordingly when accounting for the transactions.

18.

Q:

If the room rates provided by OTA vary at different times of a day, which room rate should be used to compute HAT for that day?

A:

HAT shall be calculated based on the room rate provided by the hotel to the OTA. The changes in the room rates provided by OTA will not affect the computation of HAT.

19.

Q:

If an OTA collects HAT for the hotel, what items should be shown on the booking statement issued by the OTA to the hotel?

A:

Apart from those items agreed between the hotel and OTA, the booking statement should clearly show the accommodation charge (room rate) provided by the hotel and the amount of HAT collected. For the purpose of computing HAT, a discount (if any) agreed by the hotel is deductible from the room rate and the revised room rate should be used for calculation of HAT. However, a discount offered by the OTA for its own business purposes is a non-deductible item.

20.

Q:

If a hotel rents out a room through an OTA by providing the base price of the room and then the OTA marks up the room price on their platform by themselves, which amount should be used to calculate HAT?

A:

HAT should only be calculated based on the room rate provided to the OTA by the hotel. Thus, the base price of the room shall be taken as the accommodation charge and HAT shall be calculated based on the base price.

21.

Q:

An OTA (“the first OTA”) hires rooms from a hotel and then sub-hires them to another OTA (“the second OTA”) and the second OTA may in turn sub-hire the rooms to the third OTA and so on. In such circumstances, which amount should be used to calculate HAT?

A:

HAT should only be calculated based on the room rate provided to the first OTA by the hotel, which shall be taken as the accommodation charge.

22.

Q:

Should the accommodation charge and HAT be separately shown on the bill issued to a guest by a hotel or an OTA?

A:

Regardless of how the room is booked, the bill issued to the guest must state clearly the amount of HAT collected or that the total amount charged is inclusive of HAT for future inspection by the IRD. For example, if the bill issued by the hotel or the OTA does not show the individual charge items separately, a note must be added in the bill stating that the total amount charged includes HAT.

23.

Q:

If a guest booked a hotel room through an OTA and paid the accommodation charge to the OTA but the OTA has not collected HAT from the guest, how could the guest pay HAT?

A:

The hotel may collect the HAT from the guest direct upon check-in. The bill issued to the guest by the hotel must state clearly the amount of HAT collected or that the total amount charged is inclusive of HAT for future inspection by the IRD. If the bills issued by the hotel or the OTA do not show the individual charge items separately, a note must be added in the bill stating that the total amount charged includes HAT.

24.

Q:

A:

As the points or cash coupons have money’s worth which can be used as money, the equivalent value of the points or cash coupons is chargeable to HAT. For instance, if a guest pays the accommodation charge of $1,000 by cash of $900 and a cash coupon of $100, HAT is calculated based on $1,000.

If the accommodation is received by a guest through redemption of the points but the room rate is not specified, HAT will be calculated on the price of the accommodation of the same grade of room on the date of stay at the time of making the redemption. The IRD will also accept the average price of the accommodation of the same grade of room as a reference for calculating the accommodation charge. The hotel must keep all information about the price of the accommodation for future inspection by the IRD.

25.

Q:

If the accommodation is sold by a hotel in the form of a package (i.e. an inclusive price covering the accommodation charge, dining, spa, etc.), how should HAT be calculated? (NEW)

A:

HAT is calculated based on the accommodation charge that is disclosed by the hotel when marketing its package deals. If the accommodation charge is not disclosed, HAT will be calculated by making reference to the price of the accommodation of the same grade of room on the dates of stay at the time of selling the package. The IRD will also accept the average price of the accommodation of the same grade of room as a reference for calculating the accommodation charge. The hotel must keep all information about the price of the accommodation for future inspection by the IRD.

If it is stated in the package that “except for the accommodation, all other services or meals included in the package are free”, HAT will be calculated on the whole package price.

26.

Q:

Since the accommodation prices of the same grade of room may be different, can a hotel use the average price of the same grade of room on the date of selling the package as a reference for calculating HAT on the package?

A:

The IRD will accept the average price of the accommodation of the same grade of room as a reference for calculating the accommodation charge.

27.

Q:

If a hotel provides one night complimentary accommodation when marketing a wedding package, is the accommodation subject to HAT?

A:

If the price of the wedding package will not vary regardless of whether the guest accepts the hotel accommodation, the package will not be regarded as one for hiring hotel room, and the accommodation will not be subject to HAT.

28.

Q:

Is a hotel required to disclose the accommodation charge and HAT separately on the bill issued to the guest for a package deal?

A:

The hotel needs to state clearly the amount of HAT collected or that the total amount charged is inclusive of HAT on the bills issued to guests to substantiate the basis for calculation of HAT for future inspection by the IRD.

29.

Q:

If a guest fails to show up to check-in, or fails to pay the accommodation charge for accommodation received (i.e. bad debt), does the hotel proprietor need to pay HAT?

A:

If a guest does not show up to check-in, it means that the guest has not received accommodation. Under such circumstance, the hotel does not need to pay HAT. If a guest fails to pay the accommodation charge, the hotel does not need to pay HAT for the unpaid accommodation charge.

30.

Q:

A:

If a hotel enters into a contract with a product supplier or service provider whereby hotel accommodation is provided in return for the products or services provided by the supplier or provider, HAT will generally be levied on the contract price mutually agreed upon by the parties. If there is no mutually agreed price, HAT will be calculated on the price of the accommodation of the same grade of room on the date of stay at the time of making such contract or booking the room.

Depending on the circumstances of each case, if a hotel room is provided as complimentary accommodation to a KOL in return for the promotional services rendered by the KOL, such promotional services are considered as money’s worth equivalent to payment for the accommodation charge in money. Thus, the hotel proprietor is required to pay HAT for the accommodation.

If a contract is entered into with a KOL, whether in verbal or written form, HAT will be levied on the price of the accommodation specified in the contract. If the room rate is not specified in the contract, the price of the accommodation of the same grade of room on the date of stay at the time of making such contract or booking the room should be used for calculation of HAT instead. The IRD will also accept the average price of the accommodation of the same grade of room as a reference for calculating the accommodation charge.

The hotel must keep all information about the price of the accommodation for future inspection by the IRD.

31.

Q:

If a hotel room is provided as complimentary accommodation to an overseas guest at the request of the Government or an official body (such as the Hong Kong Tourism Board) for promoting Hong Kong, does the hotel proprietor need to pay HAT?

A:

Depending on the circumstances of each case, it will not be considered as an exchange for services with money’s worth since the guest has not rendered any services to the hotel. The hotel does not need to pay HAT in respect of the hotel room.

32.

Q:

If hotel rooms are provided for use by its employees, is this arrangement required to be reported and HAT required to be paid? (NEW)

A:

If hotel rooms are provided to its employees for short-term stays (e.g. under adverse weather conditions) or as staff quarters, although no HAT is chargeable, the hotel is still required to report the relevant information to IRD for record purposes. If the rooms are used as staff quarters, the information reported in an HAT return should include the room number, the period, the occupant’s name, and the related file number of the Employer’s Return. For short-term stays of its employee, the information reported should include the date of occupancy and the number of rooms involved. The hotel must keep all information about the usage of the accommodation for future inspection.

If the hotel offers employees a discount on their accommodation charges, the HAT will be calculated on the actual amount of accommodation charges paid by the employees.

33.

Q:

When should the HAT return be filed?

A:

After the resumption of collection of HAT, the IRD issued the first quarterly HAT returns to the managers of hotels or guesthouses on 2 January 2025. For subsequent quarters, the quarterly HAT returns will be issued on the first working day of April, July, October and January in each year in accordance with the Hotel Accommodation Tax Ordinance.

The managers of hotels or guesthouses should sign the quarterly HAT returns and send them to the IRD within 14 calendar days after the quarters ending on 31 March, 30 June, 30 September and 31 December in each year.

34.

Q:

When should HAT be paid?

A:

The hotel shall pay to the IRD, within 14 calendar days after 31 March, 30 June, 30 September and 31 December in each year, the amount of HAT payable in respect of the quarters ending on those dates.

35.

Q:

The manager of every hotel is required to submit the quarterly HAT return within 14 days after the end of each quarter by the IRD. Is it possible to extend the 14-day requirement?

A:

The Hotel Accommodation Tax Ordinance does not empower the IRD to extend the deadline for submitting the quarterly HAT return.

36.

Q:

How can a hotel proprietor pay HAT? (NEW)

A:

A hotel proprietor may make the payment of HAT through the following methods:

| (i) | use electronic means by using the Shroff Account Number printed on the top right hand corner of the front page of the quarterly HAT return and selecting "Stamp Duty / 04-Stamp Duty" as the bill type, when required; |

| (ii) | pay by cash, cheque or EPS at post offices by using the Shroff Account Number and the CRC reference 20615 printed on the top right hand corner of the front page of the quarterly HAT return, or presenting the demand note as mentioned in paragraph (iv) below. The daily cash payment at post offices shall be less than $120,000; |

| (iii) | send a crossed cheque made payable to "The Government of the Hong Kong Special Administrative Region" or "The Government of the HKSAR" to the Collector of Stamp Revenue; or |

| (iv) | visit the Inspection Section on 3/F of the Inland Revenue Centre in person and request the issue of a demand note with bar code and QR code to pay HAT via the Faster Payment System, or pay at post offices or convenience stores. Please note that cash payment up to $5,000 per transaction is accepted at convenience stores. |

For details, please refer to the payment methods.

37.

Q:

When will inspections be carried out by the IRD? What documents are to be examined during the inspection?

A:

Where necessary, tax inspectors of IRD will carry out inspections at hotels to check the accommodation charges paid by guests to ensure that the correct amount of HAT has been paid by the hotel proprietors. For this purpose, the records to be inspected by the tax inspectors include the guest register, the occupied rooms report, the guest ledger, and the daily room sales report. If the hotel has provided long-term accommodation, the tax inspectors may also inspect the relevant tenant agreements, proof of stay, rental receipts, etc.

38.

Q:

What is the penalty for late payment of HAT or late submission of the quarterly HAT return?

A:

The IRD may initiate prosecution in respect of late payment of HAT or late submission of quarterly HAT return. Upon summary conviction, the maximum fine is at level 4 (currently $25,000).

39.

Q:

What are the meanings of “Number of Rooms Available for Hire”, “Number of Rooms Hired” and “Accommodation Charges as Shown in Ledger” in the Return of Accommodation Charges? (NEW)

A:

"Number of Rooms Available for Hire" refers to the total number of room nights available for hire in the month, excluding the accommodation where the accommodation charges are not subject to HAT, such as rooms for long-term stays (i.e. the same guest stays for not less than 28 consecutive nights) or private use or other rooms which are not available for hire.

"Number of Rooms Hired" refers to the total number of room nights hired in the month. If a room was hired more than once in a single day, the "Number of Rooms Hired" in the month will exceed the "Number of Rooms Available for Hire".

"Accommodation Charges as Shown in Ledger" refers to the total amount of accommodation charges in the ledger for the month, rounded to two decimal places, but does not include those not subject to HAT, such as charges from long-term stays.

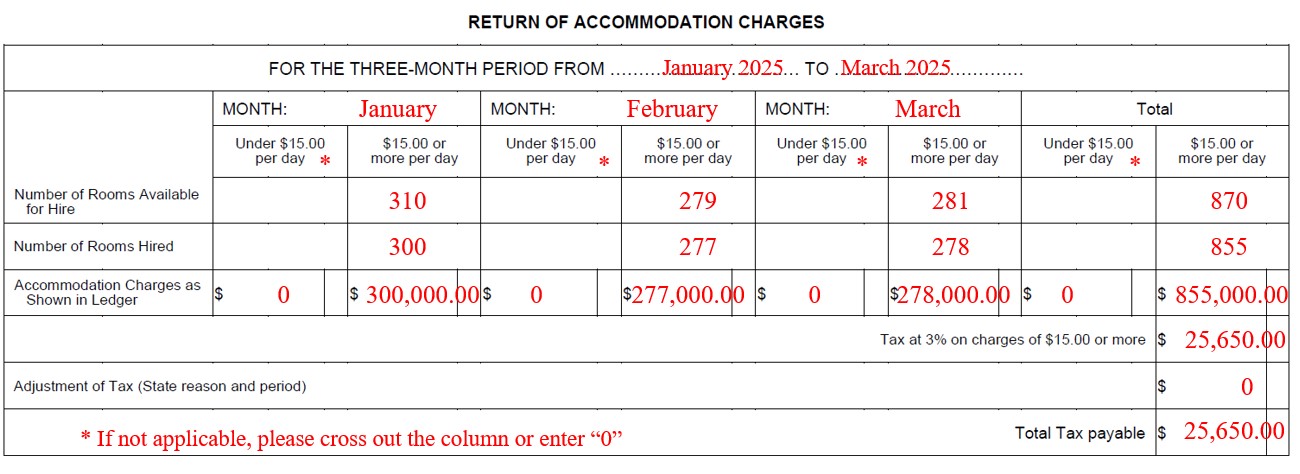

Example: Hotel A has 10 rooms available for hire with a daily rate of $1,000 per room.

| Scenario 1: In January 2025, no room was for long-term stay or private use. The total number of rooms hired is 300. | |||

| Month | Number of Rooms Available for Hire | Number of Rooms Hired |

Accommodation Charges as Shown in Ledger |

| Jan | 10 rooms x 31 nights = 310 | 300 | $300,000.00 |

| Scenario 2: In February 2025, in addition to a room for 1 night’s private use, Hotel A provided a complimentary room for a KOL to stay for 1 night to promote the hotel and a room for a supplier to stay for 1 night in exchange for goods. The total number of other rooms hired is 275. | |||

| Month | Number of Rooms Available for Hire | Number of Rooms Hired |

Accommodation Charges as Shown in Ledger |

| Feb | 10 rooms x 28 nights – 1 room x 1 night (private use) = 279 |

277 [(275+2), including 2 nights of complimentary room] |

$277,000.00 (including the reference room rate for 2 nights of complimentary room, i.e. $2,000.00) |

| Note: The complimentary rooms provided by Hotel A to the KOL and supplier are subject to HAT (please refer to Frequently Asked Question No. 30 for details). In this case, the reference room rate for each complimentary room is $1,000.00 per night. | |||

| Scenario 3: In March 2025, a room was occupied for private use for one night and a room was hired by a guest for 28 consecutive nights. The total number of rooms hired is 278. | |||

| Month | Number of Rooms Available for Hire | Number of Rooms Hired |

Accommodation Charges as Shown in Ledger |

| Mar | 10 rooms x 31 nights – 1 room x 28 nights (long-term stay) – 1 room x 1 night (private use) = 281 |

278 | $278,000.00 |

The Return of Accommodation Charges should be completed as follows: -

40.

Q:

What is “Adjustment of Tax” in the Return of Accommodation Charges intended for? (NEW)

A:

“Adjustment of Tax” can be used to report the difference between the amount of HAT calculated based on 3% of the quarterly total amount of accommodation charges and the aggregate amount of HAT calculated based on the accommodation charges per room per night as recorded in the ledger.

In addition, if any accommodation charge subject to HAT becomes a bad debt, please state the relevant tax amount to be deducted with the reasons and the period to which it relates under “Adjustment of Tax”.

RSS

RSS  Share

Share Printer View

Printer View