Business Tax Portal (BTP)

- Overview

- Getting Started with BTP

- Users under BTP

- Account Registration and Management under BTP

- Upcoming BTP Online Services (available after the full launch in late July 2025)

- Frequently Asked Questions

back to New Portals under eTAX

BTP is a new electronic platform dedicated for Businesses to handle tax and/or business affairs in a more convenient and efficient way. After registered with BTP, Businesses can submit their tax returns online, view their e-filed tax returns and tax assessments issued, request to amend an assessment, and communicate with the IRD on other tax related matters. Additionally, the BTP also provides a channel for e-filing of Employers’ returns, and conducts matters relating to stamp duty, certificate of resident status and business registration.

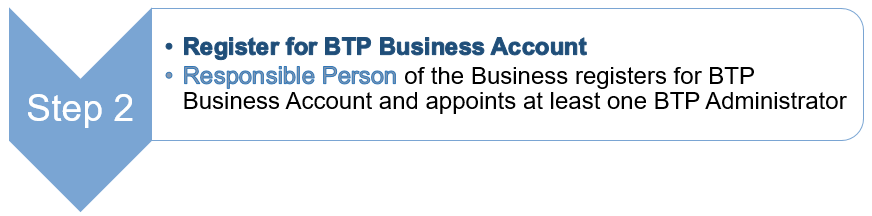

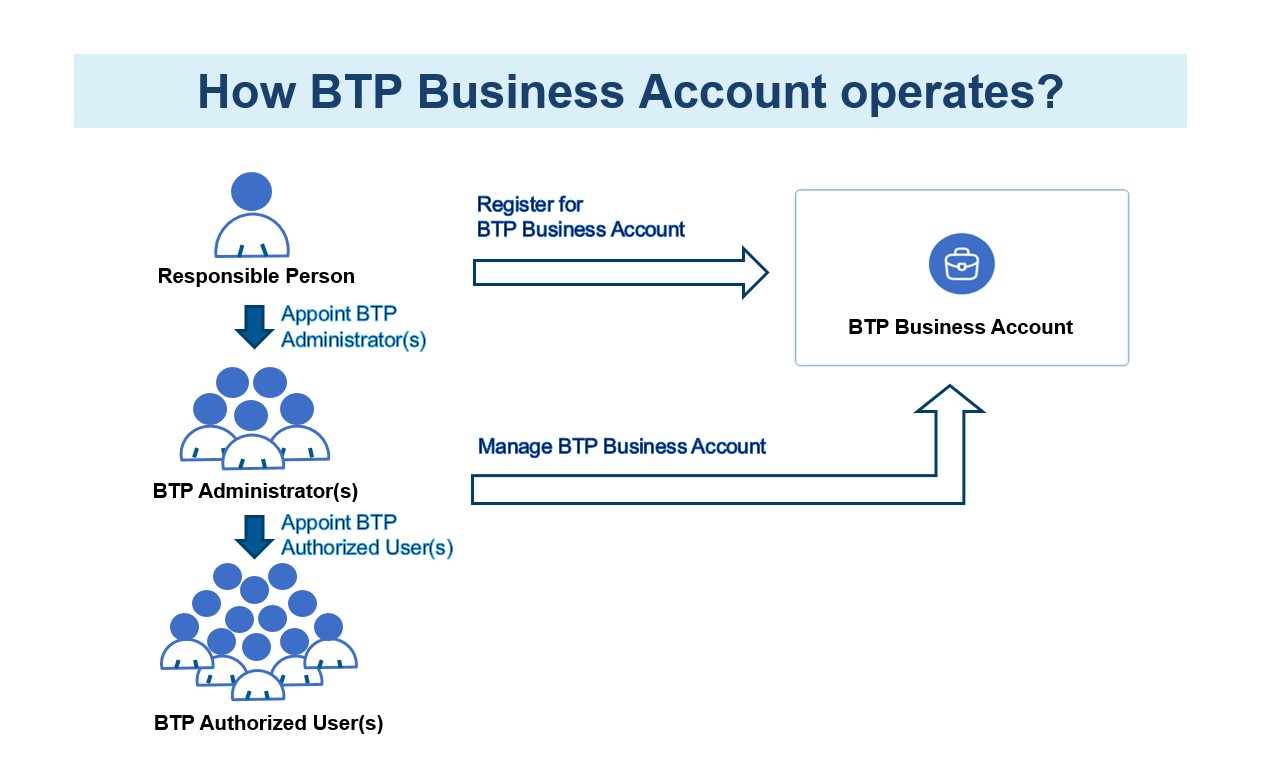

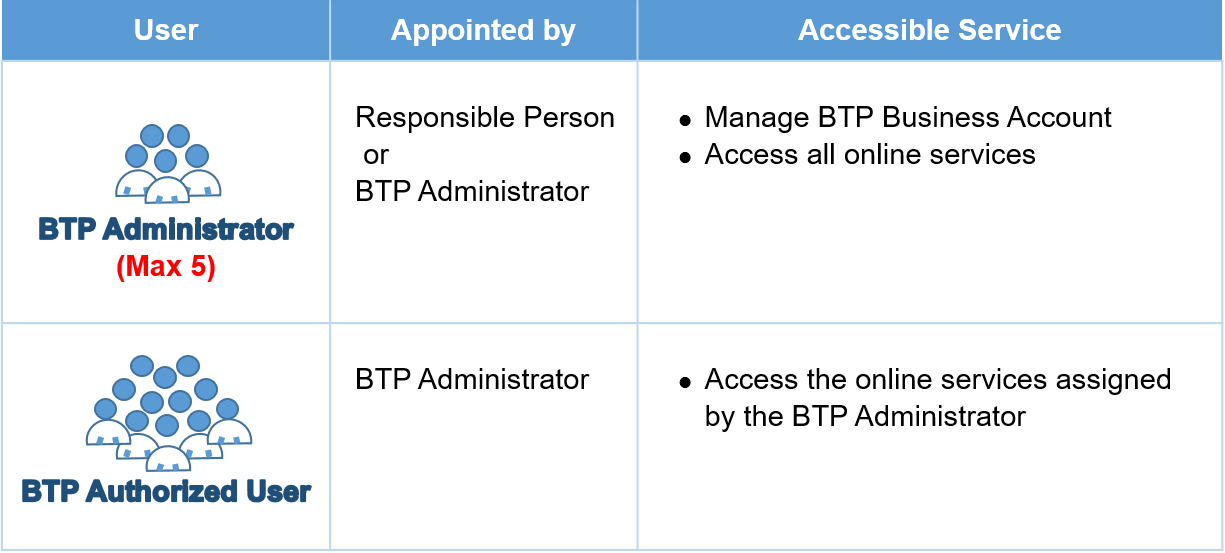

To access the online services available under BTP, the Responsible Person of the Business needs to first open a BTP Business Account, then appoint BTP Administrator(s), who are responsible for managing the BTP Business Account and in turn appoint other BTP Authorized User(s) for the Business. Only those BTP Administrator(s) and BTP Authorized User(s) appointed by the Business can handle tax and/or business affairs of the Business under BTP.

Quick Steps

| BTP Administrators / BTP Authorized Users are ready to use the upcoming BTP online services! |

The Responsible Person of the Business can appoint BTP Administrators, who are responsible for managing the BTP Business Account and in turn appoint other BTP Administrator(s) and BTP Authorized User(s) for the Business. BTP Administrators are also given right to access all online services available under BTP while BTP Authorized Users' right of access to the online services is assigned by the BTP Administrators. Each BTP Business Account can have no more than five BTP Administrators while the number of BTP Authorized Users is unlimited.

Account Registration and Management under BTP

1. BTP Business Account Registration

To access the online services available under BTP, a Business need to open a BTP Business Account. Only the Responsible Person (RP) of the Business can register for a BTP Business Account.

Depending on the legal form or arrangement of the Business, the RP must be a natural person in one of the following capacities:

| (a) | secretary or director of a corporation; | ||

| (b) | partner in a partnership; | ||

| (c) | general partner in a limited partnership fund; | ||

| (d) | principal officer of a body of persons; or | ||

| (e) | sole proprietor of a sole proprietorship business. | ||

Just a few steps to register for BTP Business Account: -

| 1 | Read Terms and Conditions | ||

| 2 | Authenticate Your Identity | ||

| 3 | Provide Details of BTP Business | ||

| 4 | Appoint BTP Administrator | ||

| 5 | Provide Your Contact Details | ||

| 6 | Confirmation | ||

| 7 | Acknowledgement | ||

| Points to Note: | |||

| 1. | The RP will need to verify his/her identity by using one of the three digital authentication mechanisms available: | ||

| (i) | iAM Smart | ||

| (ii) | Individual Tax Portal (ITP) TIN & Password* | ||

| (iii) | Personal Digital Certificate | ||

| * If the RP chooses to verify his/her identity through ITP, he/she will be redirected to the login page of eTAX for authentication before the ITP is launched in late July 2025. The RP should ensure that he/she can log in to the existing eTAX. | |||

| 2. | The RP is required to appoint BTP Administrator(s) who is/are responsible for managing the BTP Business Account. The RP can appoint himself/herself and/or others as BTP Administrators and each BTP Business Account can have no more than five BTP Administrators. BTP Administrator to be appointed must register for his/her own BTP User Account first in order to activate the appointment. | ||

| 3. | In case of Corporation, registration is subject to approval as the RP’s identity will be verified against the record kept by the Companies Registry. | ||

| 4. | Both RP and appointed BTP Administrator(s) will receive notifications when the BTP Business Account is ready for use. | ||

For Online Demo and User Guide about BTP Business Account Registration, please click here![]() .

.

2. BTP User Account Registration

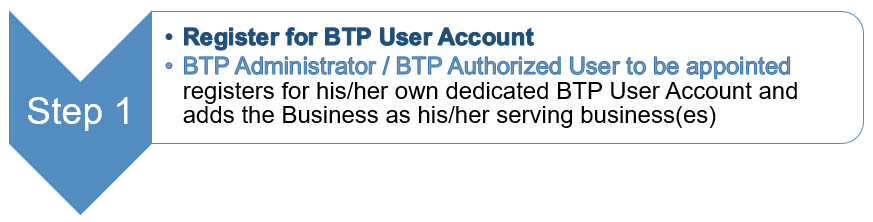

The Responsible Person (RP) and the BTP Administrator(s) may designate and appoint other individuals within the Business as BTP Administrator(s) or BTP Authorized User(s). To activate their appointments, these individuals need to register for their own dedicated BTP User Account first and add the Business to their serving business list kept under their account profile.

Before registering for a BTP User Account, an individual must possess an Individual Tax Portal (ITP) Account. The BTP User Account is for business-use and is distinct from the ITP Account that is designated for handling individual tax affairs.

Access to the Online Services under BTP shall only take effect after the BTP User Account registration is complete and that individual is appointed as a BTP Administrator or BTP Authorized User.

Just a few steps to register for BTP User Account: -

| 1 | Read Terms and Conditions | ||

| 2 | Authenticate your identity with ITP | ||

| 3 | Create BTP Username & Password | ||

| 4 | Set up BTP User Account Profile | ||

| 5 | Provide Details of BTP Business(es) You Serve | ||

| 6 | Confirmation | ||

| 7 | Acknowledgement | ||

| Points to Note: | |||

| 1. | You must possess an ITP Account for verifying your identity during the registration of a BTP User Account. Before the ITP is launched in late July 2025, you will be redirected to the login page of eTAX for authentication when registering. Please ensure that you can log in to the existing eTAX. | ||

| 2. | BTP User Account is your own dedicated account for business use. You will have to provide your BTP Username to your serving business(es) for appointing you as the BTP Administrator or BTP Authorized User. As the BTP Username cannot be changed once the registration is completed, please select your BTP Username carefully. | ||

| 3. | To allow your serving business(es) to appoint you as its BTP Administrator or BTP Authorized User, you have to add the Business Registration Number of such business(es) to your Serving Business List. | ||

| 4. | You can opt in your account profile to receive an e-alert email whenever an e-message is sent to the Business under BTP. | ||

For Online Demo and User Guide about BTP User Account Registration, please click here![]() .

.

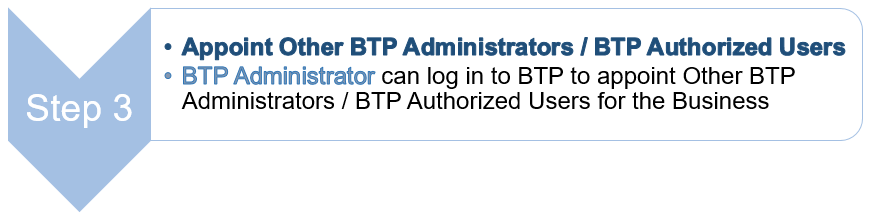

3. Manage BTP Administrator / Authorized User

This function enables the BTP Administrator(s) to:

- view the BTP Administrator(s) and BTP Authorized User(s) currently appointed by the Business;

- add/remove the BTP Administrator(s) / Authorized User(s); and

- update their user details, such as designation and change their appointed service scopes.

For Online Demo and User Guide about Manage BTP Administrator / Authorized User, please click here![]() .

.

This function enables BTP Administrator(s) to view the currently appointed Service Agent(s) of the Business; add/remove Service Agent(s) or update their appointed role(s) and service(s). Then through Tax Representative Portal, the appointed Service Agent can view the Business’s tax information and access online services as assigned by the Business.

The type of Service Agents and the scope of services that BTP Administrator can appoint/update are shown as follows:

| Tax Representative | Profits Tax Matters Certificate of Resident Status |

||

| Service Provider | Filing of Profits Tax Return | ||

| Company Secretary | Business Registration Matters Certificate of Resident Status |

||

For Online Demo and User Guide about Manage Service Agent, please click here![]() .

.

Upcoming BTP Online Services (available after the full launch in late July 2025)

The BTP will soon offer a wide range of online services to enable Businesses to handle their tax and/or business matters in a more convenient and efficient manner, including services related to: -

- Profits Tax Matters

- Property Tax Matters

- Business Registration Matters

- Employer's Matters

- Stamp Duty

- Certificate of Resident Status

- Purchase of Tax Reserve Certificate

Click here to read the frequently asked questions about BTP.

RSS

RSS  Share

Share Printer View

Printer View